Mastering Forex Trading Online Your Comprehensive Guide

Ubaid Majeed is the Editor-in-Chief at the Mountain Ink.

Forex trading online has revolutionized the way traders participate in global currency markets. With platforms like trading forex online Jordan Brokers, even novice traders can access the vast world of currency trading with just a few clicks. In this article, we will delve into the essentials of trading Forex online, including tips for success, common strategies, and the importance of risk management.

Understanding Forex Trading

Forex, or foreign exchange, involves exchanging one currency for another, typically with the aim of making a profit. The forex market is the largest and most liquid financial market in the world, boasting a daily trading volume exceeding $6 trillion. Unlike stock markets, forex trading operates 24 hours a day, five days a week, providing ample opportunities for traders across the globe.

Getting Started with Online Forex Trading

If you’re new to forex trading, here are some key steps to help you get started:

- Choose a Reliable Broker: Selecting a reputable forex broker is crucial to your trading success. Look for brokers that are regulated, offer low spreads, and provide a user-friendly trading platform.

- Open a Trading Account: Once you’ve chosen a broker, you’ll need to open a trading account. Most brokers offer different types of accounts, including standard, mini, and micro accounts, catering to various trading styles and budgets.

- Learn the Basics: Understanding fundamental concepts like currency pairs, pips, leverage, and margin is essential. Familiarize yourself with terms such as bids, asks, and spreads.

- Practice with a Demo Account: Many brokers offer demo accounts that allow you to practice trading with virtual money. This is a crucial step to build your confidence and test your strategies without financial risk.

Key Strategies for Trading Forex Online

Once you’ve established a foundational understanding of forex trading, it’s time to explore some effective strategies:

1. Day Trading

Day trading involves opening and closing trades within the same trading day. This strategy requires a keen understanding of market movements and quick decision-making abilities. Traders often use technical analysis to identify trends and potential entry and exit points.

Support Our Journalism

You are reading this because you value quality and serious journalism.

But, serious journalism needs serious support. We need readers like you to support us and pay for making quality and independent journalism more vibrant.

2. Swing Trading

Swing trading focuses on capturing gains within a medium timeframe, typically holding positions for several days to weeks. This approach allows traders to take advantage of expected upward or downward shifts in price, using both technical and fundamental analysis to guide their decisions.

3. Scalping

Scalping is a high-frequency trading strategy that involves making numerous trades within short timeframes, often just a few seconds to a minute. Scalpers aim to exploit small price gaps for a profit, relying on the rapid execution of trades and requiring a firm understanding of market dynamics.

Risk Management in Forex Trading

Effective risk management is a vital component of successful forex trading. Here are some strategies to help you manage risk:

- Use Stop-Loss Orders: A stop-loss order automatically closes a trade at a specified price level to limit potential losses. This tool can help you protect your capital and minimize emotional decision-making during volatile market conditions.

- Position Sizing: Determining the appropriate size of your trades based on your account size and risk tolerance is essential. Avoid overleveraging your positions to prevent significant losses.

- Diversification: Diversifying your trades across different currency pairs can help mitigate risk. By not putting all your capital into a single trade, you can reduce the impact of market fluctuations.

Utilizing Technology for Successful Trading

In today’s fast-paced trading environment, leveraging technology can significantly enhance your trading experience. Here are some technological advancements you should consider:

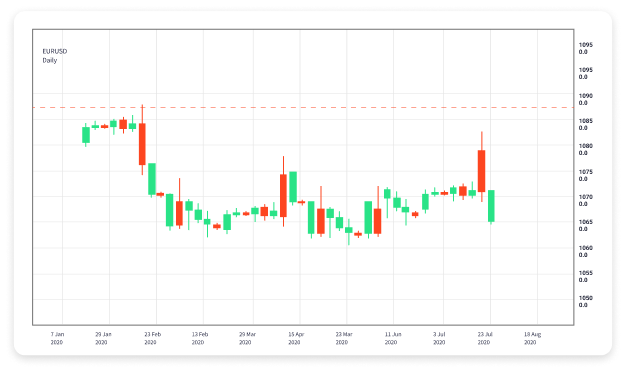

- Trading Platforms: Advanced trading platforms offer a suite of tools, including charting capabilities, technical indicators, and news feeds. Familiarizing yourself with these tools can improve your analysis and decision-making process.

- Automated Trading Systems: Some traders use automated trading systems or algorithms to execute trades based on preset conditions. This approach can remove emotional biases and allow for more disciplined trading.

- Mobile Trading: With mobile trading applications, you can monitor your trades and market conditions on the go. This flexibility keeps you connected to the market and enables quick responses to changing circumstances.

Continual Learning and Adaptation

The forex market is constantly evolving, making it essential for traders to stay informed about market trends, economic indicators, and geopolitical events that can influence currency movements. Continuous learning through reading books, attending webinars, and following expert analysts will help you refine your trading strategies.

Conclusion

Trading forex online can be an exciting and profitable venture, but it requires dedication, knowledge, and a solid strategy. By choosing the right broker, mastering key trading strategies, implementing effective risk management techniques, and leveraging technology, you can navigate the foreign exchange market with confidence. Remember, success in forex trading is a journey—stay curious, stay disciplined, and keep learning to truly master the art of forex trading.

Mountain Ink is now on Telegram. Subscribe here.

Become Our Ally

To help us strengthen the tradition of quality reading and writing, we need allies like YOU. Subscribe to us.